Select Rewards

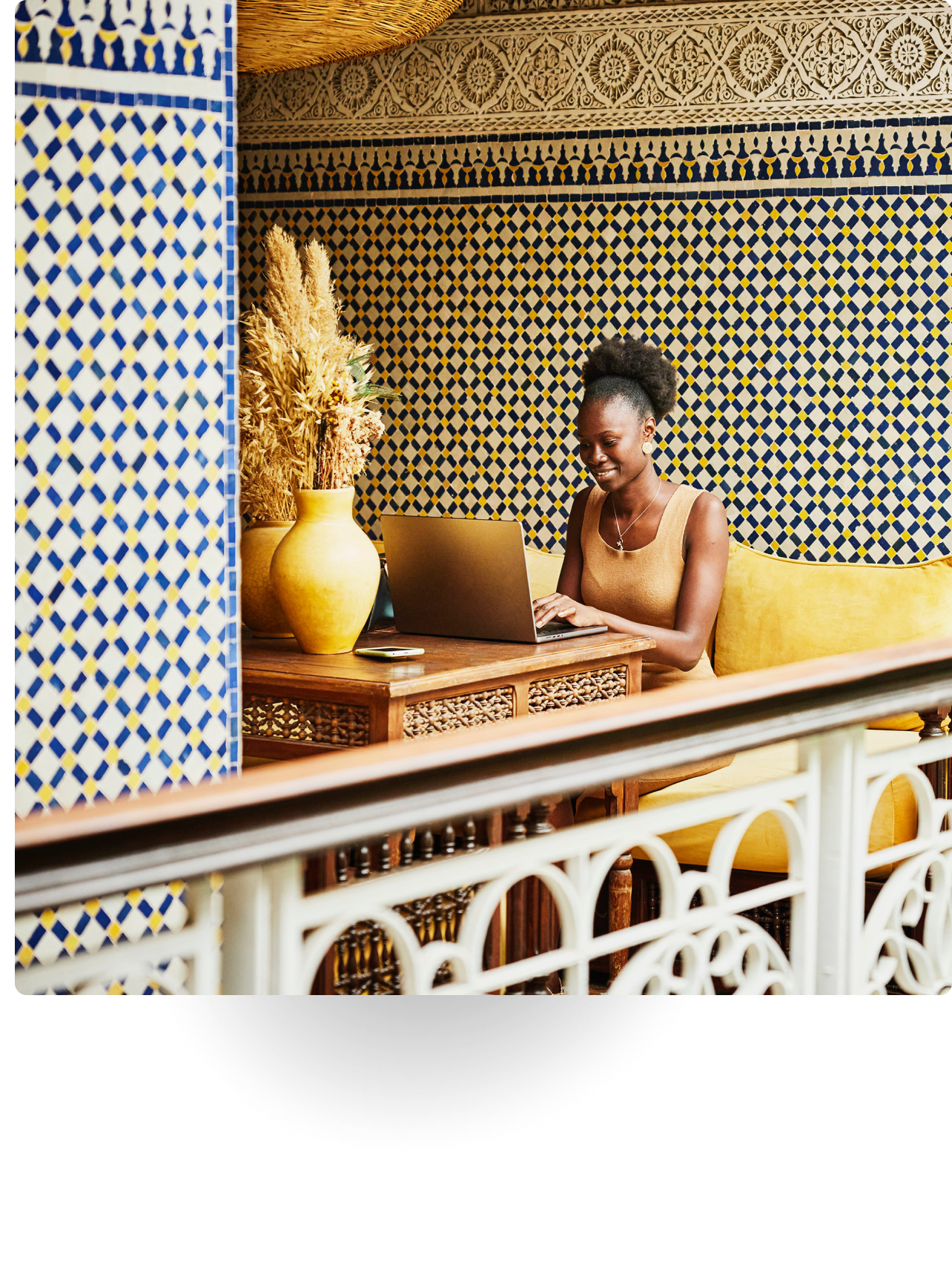

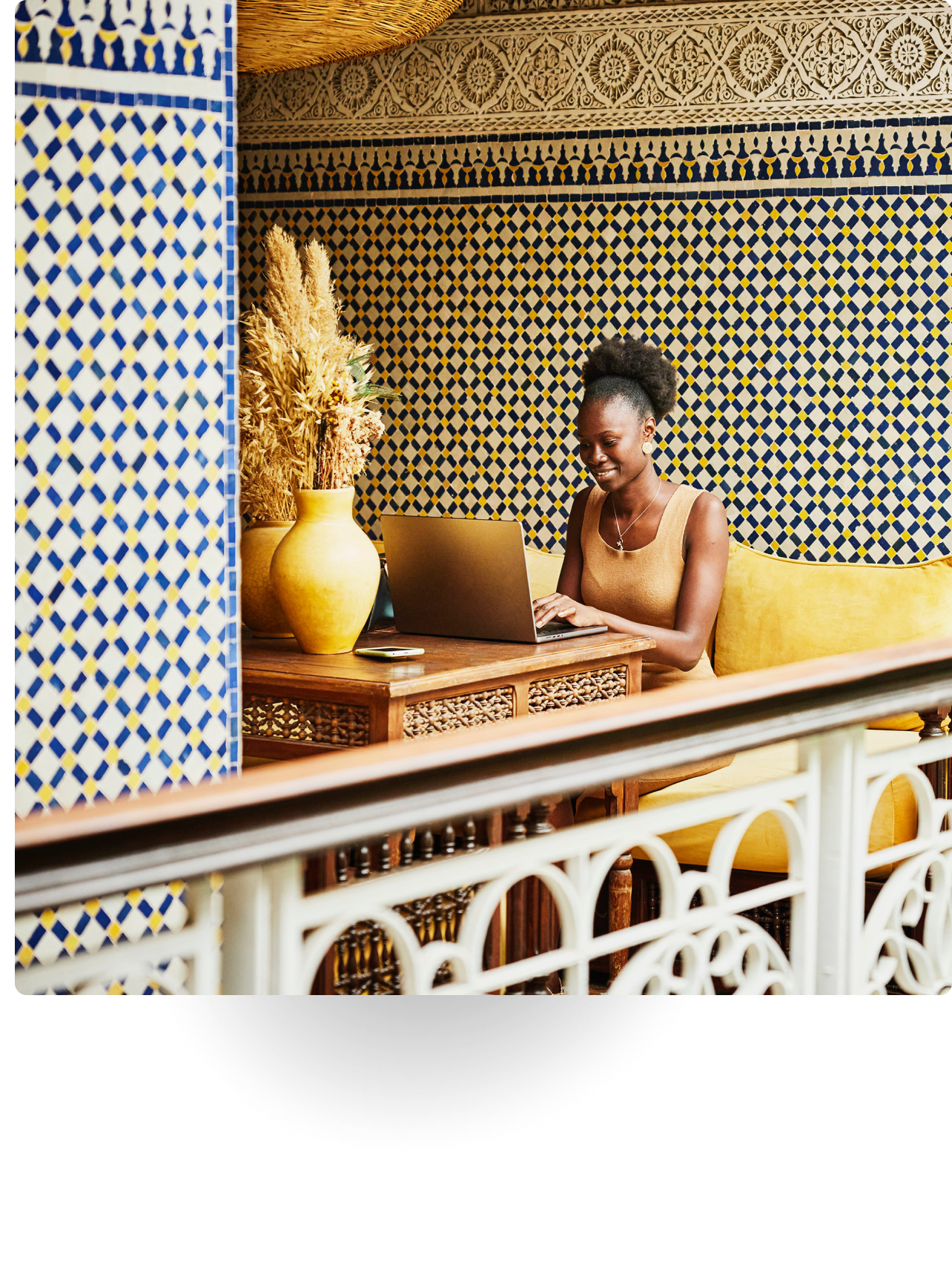

Bank accounts are designed to accommodate your daily needs to send and receive payments, manage account balances for liquidity requirements and set aside funds for a special purpose, to invest or to earn interest. Zelle® for Small Business is available to send and receive money with small businesses and consumers who are enrolled in Zelle®.

ACH collections, Zelle® and Merchant Services streamline availability of funds in your account. Lockbox Services and Remote Deposit Capture speed processing and save the time needed to visit one of our branches in Florida or Puerto Rico to deposit paper checks. Our automated Zero Balance Accounts, for businesses incorporated in the U.S., ensure the smooth transfer of idle cash from operating, payroll and other accounts to and from a master account, while maintaining adequate balances to cover expenses.

We provide solutions that enhance capabilities to manage your balance sheet for liquidity. Digital payables services, including wire transfers, and online and mobile bill pay offer the flexibility to time the release of funds. Our commercial lines of credit and investment-secured loans available through our partnership with Miura Capital provide the opportunity to elevate working capital, finance an expansion or acquire income-producing assets without drawing down cash.

Account activity is monitored to detect potential fraud. Your historical transaction patterns are analyzed and any deviation is brought to your attention.

Payee Positive Pay detects potential fraud by matching your payee and other information with checks presented for processing.

Our online banking tools make it easy to add and remove authorized users, set up transaction limits and view processing history.

Two-factor authentication provides added protection to bank using our mobile app, and paperless statements and account notices are posted in your online account to view and download.

Banesco USA accounts are insured by the FDIC up to the standard maximum amount. We offer additional FDIC-insurance protection through the IntraFi Cash ServiceSM (ICS). Deposit accounts with balances above $250,000 are eligible.

Letters of Credit enable you to strengthen relationships with a guarantee of payment.

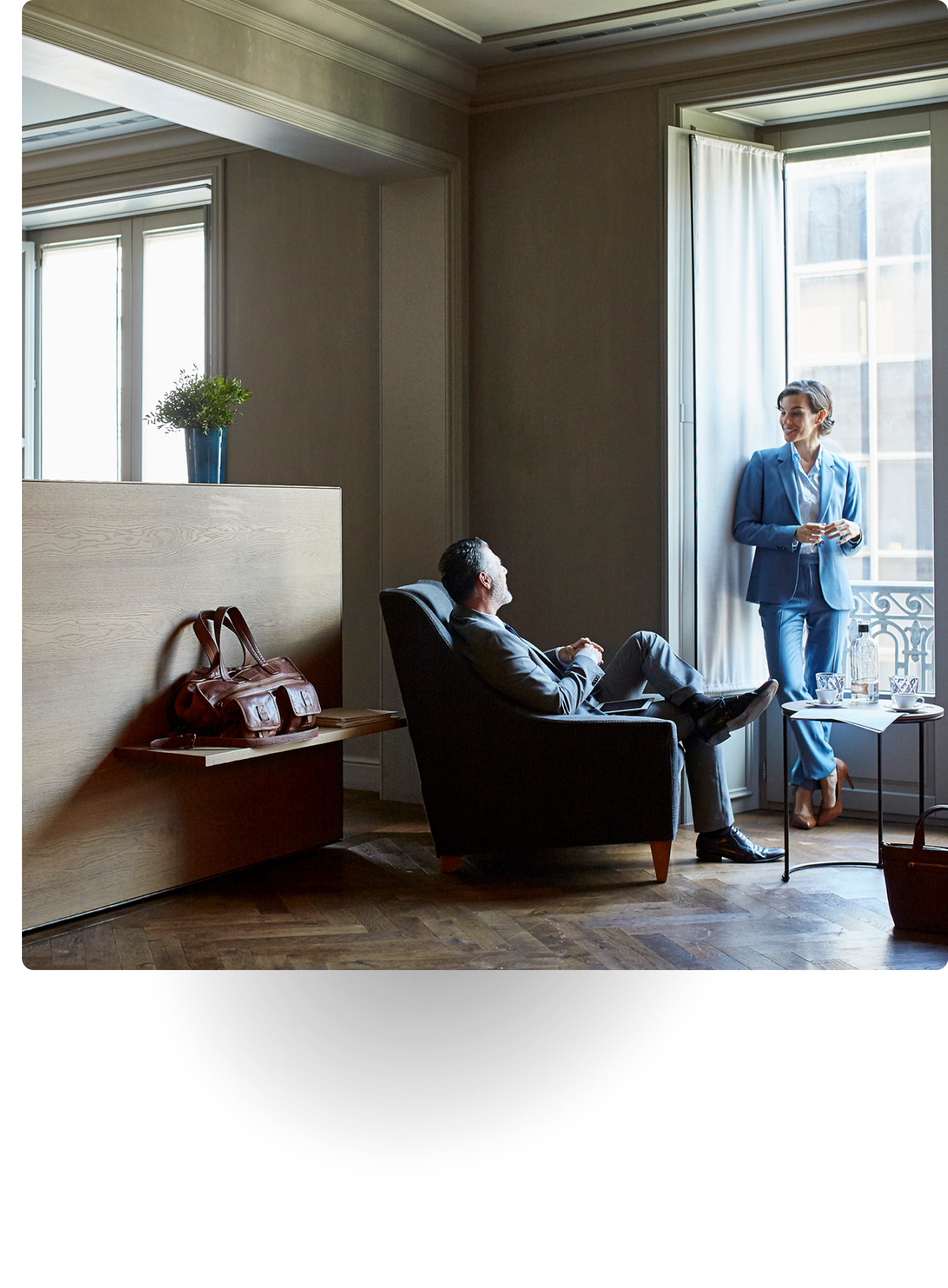

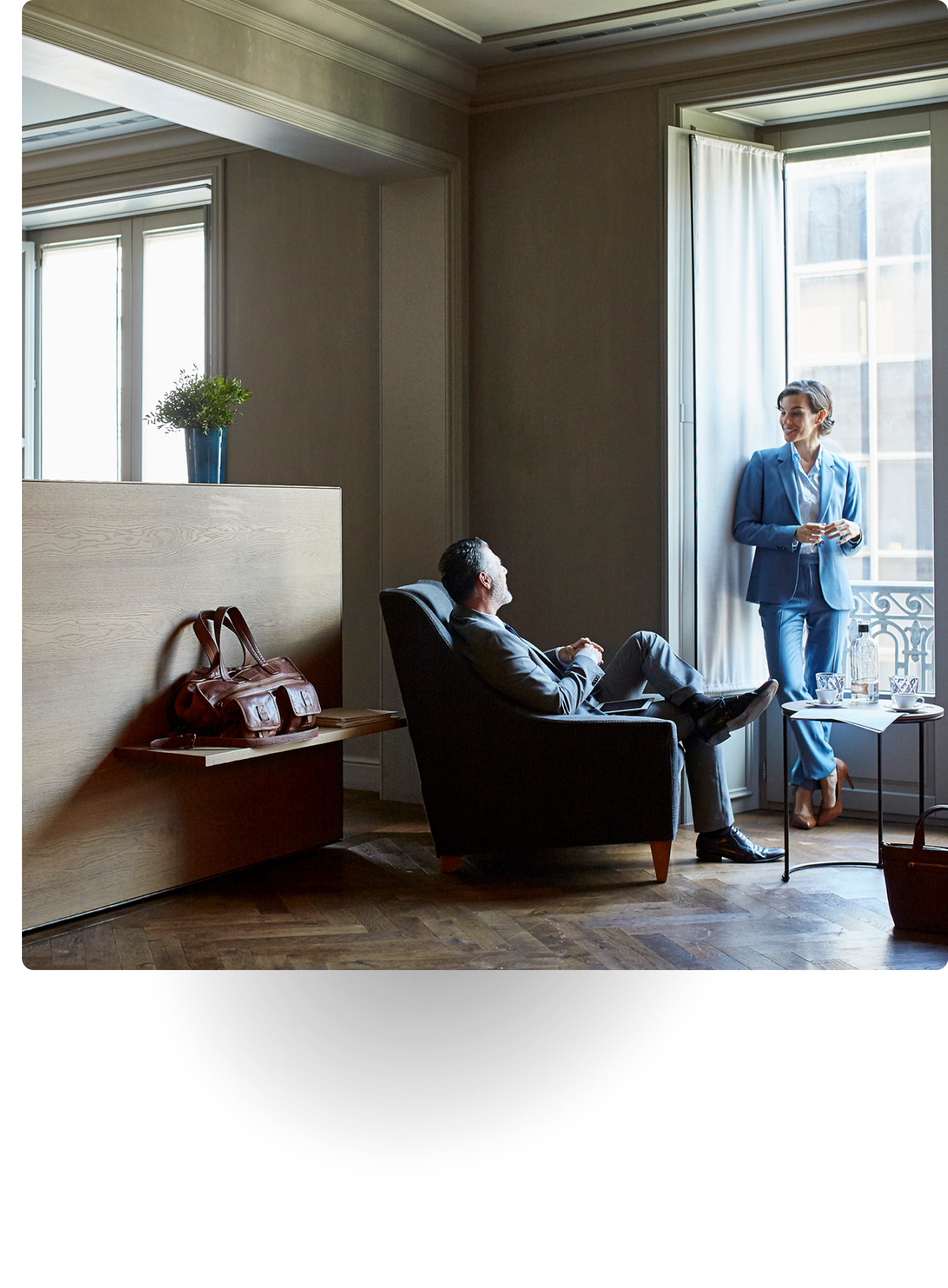

Service from your Relationship Manager is complemented by secure email messaging available through online banking and the mobile app.