Select Rewards

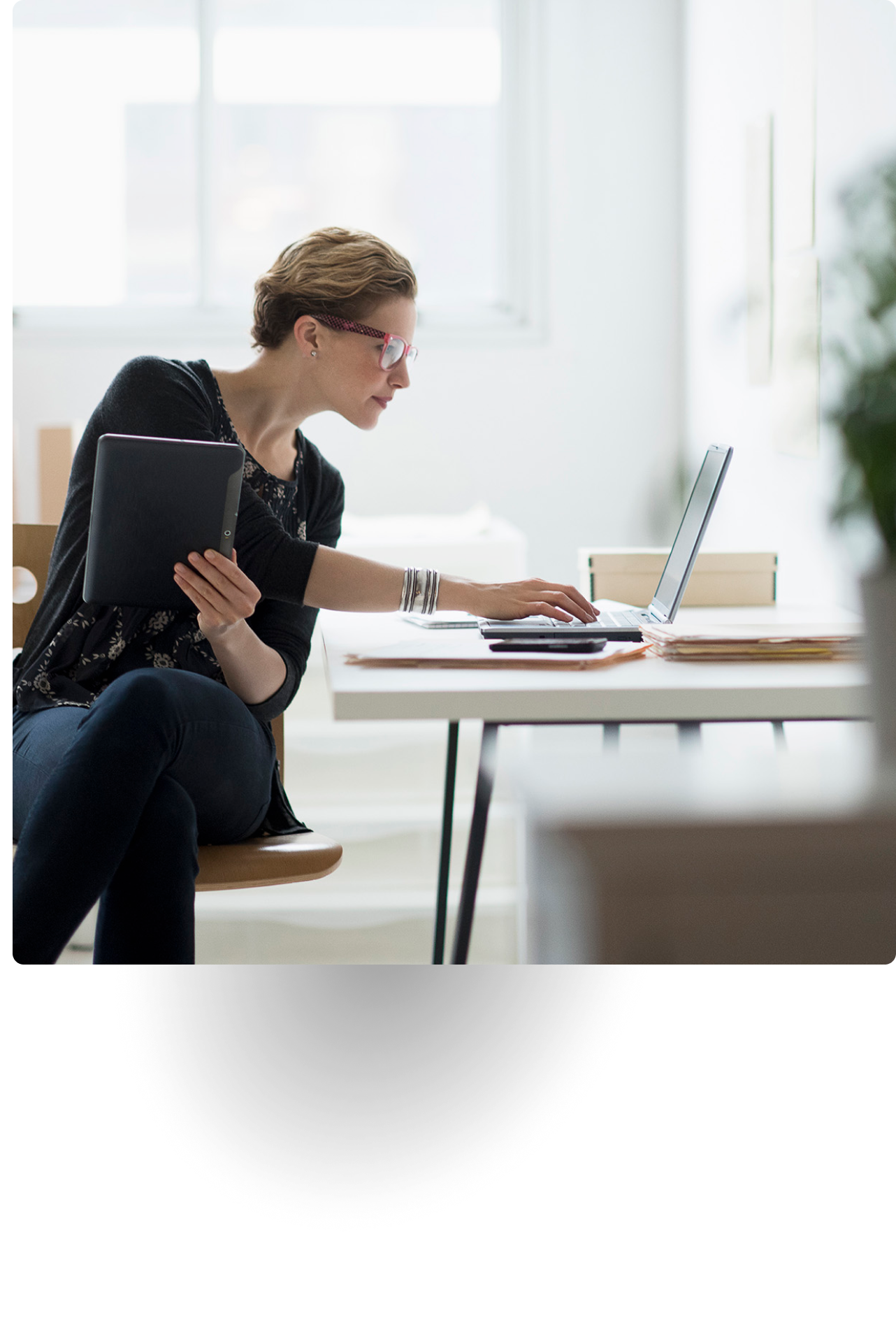

Secure online and mobile technology provide the freedom and flexibility to manage your financial affairs from anywhere in the world, while also granting access to your accounts to trusted individuals who can make transactions on your behalf. We offer strategies designed for global commerce. Global payment processing options, an expansive network of correspondent banks and lines of credit are available to support your operation.

We offer the flexibility to share access to your accounts with trusted individuals who can transact on your behalf, including the use of a VISA® Debit Card to access the account while you maintain control. Zelle® for Small Business is available to send and receive money with small businesses and consumers who are enrolled in Zelle®.

ACH collections, Zelle® and Merchant Services streamline availability of funds in your account. Lockbox Services and Remote Deposit Capture speed processing and save the time needed to visit one of our branches in Florida or Puerto Rico to deposit paper checks. Our automated Zero Balance Accounts, for businesses incorporated in the US, ensure the smooth transfer of idle cash from operating, payroll and other accounts to and from a master account, while maintaining adequate balances to meet expenses.

Digital payables solutions, for businesses incorporated in the US, including ACH origination, wire transfers, and online and mobile bill pay offer the flexibility to time the release of funds. Our commercial lines of credit and investment-secured loans available through our partnership with Miura Capital provide the opportunity to elevate working capital, finance an expansion or acquire income-producing assets without drawing down cash.

Banesco USA oversees your accounts to prevent fraud and protect you from cyber threats.

Account activity is monitored to detect potential fraud. Your historical transaction patterns are analyzed and any deviation is brought to your attention.

Payee Positive Pay detects potential fraud by matching your payee and other information with checks presented for processing.

Our online banking tools make it easy to add and remove authorized users, set up transaction limits and view processing history.

Two-factor authentication provides added protection to bank using our mobile app, and paperless statements and account notices are posted in your online account to view and download.

Banesco USA accounts are insured by the FDIC up to the standard maximum amount. We offer additional FDIC-insurance protection through the IntraFi Cash ServiceSM (ICS). Deposit accounts with balances above $250,000 are eligible.

Letters of Credit enable you to strengthen relationships with a guarantee of payment.

Service from your Relationship Manager is complemented by secure email messaging available through online banking and the mobile app.